Introduction

Are you a business owner looking to establish, grow, or repair your credit profile? If so, delving into the world of business credit builders could significantly benefit your financial trajectory. In this comprehensive guide, we will explore all you need to know about business credit builders, their benefits, how they work, and common FAQs.

Benefits of Using Business Credit Builders

Business credit builders offer a multitude of advantages for entrepreneurs. These services help establish separate credit profiles for your business, shielding your personal credit in case of financial mishaps. By utilizing BUSINESS CREDIT BUILDER accounts, you can access higher credit limits, better interest rates, and enhanced credibility with suppliers and lenders.

Moreover, a BUSINESS CREDIT BUILDER card can streamline accounting processes, allowing you to easily track business expenses. Additionally, by joining a business credit builder program, you can improve your credit score and easily qualify for business credit builder loans in the future.

Detailed Explanation of Business Credit Builders

Business credit builders are specialized services or companies that assist businesses in building strong credit profiles. They offer solutions such as adding business credit builder tradelines, providing business credit building services, and establishing relationships with business credit builder companies.

These services work by guiding business owners on how to strategically manage their finances, establish good credit habits, and navigate the complex world of business credit. By following their advice and utilizing their resources, businesses can boost their credit scores and access better financial opportunities.

Frequently Asked Questions

1. How long does it take to see results with a BUSINESS CREDIT BUILDER?

Results can vary depending on the individual circumstances of your business, but typically, you can start seeing positive effects on your credit profile within a few months of actively engaging with a BUSINESS CREDIT BUILDER.

2. Can a BUSINESS CREDIT BUILDER help me secure funding for my business?

Yes, many business credit builders offer services to help you qualify for business credit builder loans and other forms of financing by improving your creditworthiness and establishing strong business credit.

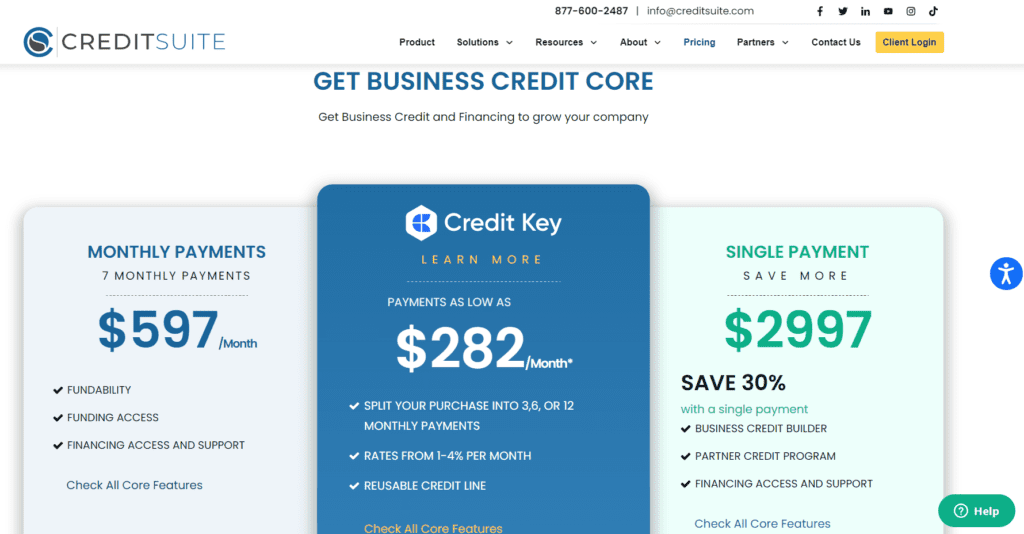

3. Are business credit builders worth the investment?

Investing in a reputable BUSINESS CREDIT BUILDER can yield significant long-term benefits for your business, such as better financial terms, increased credibility, and improved access to funding.

4. What are some reputable business credit builders?

There are several well-known business credit builders in the market, including those with positive reviews like Company A, Company B, and Company C. It’s essential to research and choose a provider that aligns with your business goals.

5. Can a business credit builder help me repair damaged credit?

Yes, many business credit builders also offer credit repair services designed to help businesses address and rectify past credit issues, ultimately improving their overall credit health.

Conclusion

Embracing the world of business credit builders can be a game-changer for your business’s financial future. By leveraging these services, you can establish a robust credit profile, access better financing options, and secure your business’s long-term success. Remember, when choosing a business credit builder, research thoroughly, read reviews, and select a provider that best suits your unique needs.